We’ve all heard the saying that hindsight is 20-20 and we find ourselves saying, “If we only knew then what we know now.” Perhaps our choices might have been different. Making decisions may not come easy for many. Throwing a divorce in the mix makes deciding things even harder. Unwinding years of memories, emotions, and finances isn’t easy, mainly for fear of the unknown. The unknowns include the impact divorce will have on the kids, the parents’ relationship if they need to co-parent, the spouses’ earning potential, where they will live, and how they will move on and succeed.

Peeling the Orange: Choices

There’s more than one way to peel an orange. That’s true for divorce. A couple can go about divorcing on their own. They can hire two “bulldog” attorneys, who can go at it for months or years. Or they can choose a path that will help them create a future that prioritizes what is most important to them both. This choice is the power of the Collaborative divorce process. When implemented well, the Collaborative Process can make all the difference in speed, cost, parenting arrangements, and financial outcomes.

As a financial professional, I find in most cases the biggest hesitation for one spouse agreeing to settlement terms relates to the finances. Rightfully so. Couples going through a divorce are making one of the most important decisions in their lives when they may be most vulnerable. While a financial affidavit may demonstrate what is true of the current situation, future unknowns are most stressful. This is where the power of foresight would be helpful.

Forecasting and Modeling Life Ahead

Unfortunately, nobody has a crystal ball, so the best we can do is forecast and project. While forecasting and projecting are no guarantee of the future, at least it provides a view into what is possible. In financial planning, we call this modeling.

Financial modeling is nothing new, but what may be new is the importance of bringing modeling into divorce negotiations. Modeling not only lets the most concerned spouse see the impact of proposed divorce terms and quantifies what may be their worst fears, but also helps ease concerns about the unknown.

Window into the Future Provides Calm

In a recent case I supported, one spouse gave up her education and career to be a housewife in a 30-year marriage and was facing what she described as her worst nightmare. She’d envisioned she and her husband would live happily ever after. But, at 63, she was now facing a future “alone.” Although she was set to split an $8,000,000 estate from the divorce, she was looking at a future of doom and gloom. No proposals were good enough. She was worried about the cost of living, the cost of health care, her eligibility for social security, the timing of Medicare, the house needing repairs, and even the new life her soon-to-be ex-husband was living without her.

Getting Foresight

The Collaborative team knew that the only way to help her get past her fears was to help her get foresight. Taking the time to sit with her to itemize her cost of living and incorporating the cost of the changes she would make in the “perfect world” we asked her to imagine was priceless. We needed to open her mind to possibilities. We asked her to dream and think about all the things she wanted to do before her marriage, so she could live that life after divorce. We went through her worst fears and conservatively estimated the cost of those fears.

After running various cost-of-living levels through a variety of models, we helped ease the woman’s anxiety over making difficult decisions. Such fear is real for divorcees in this situation. They’ve only known life with their spouse. When that world crumbles, it can be mentally crippling.

Working on a Plan

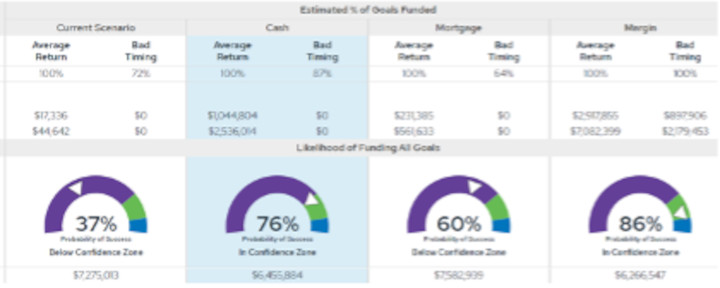

After our discussion, modeling, and analysis, we worked on a plan that captured the spouse’s goals. The plan would increase the probability of her achieving all of her goals and objectives from 37% to 86% (See Exhibit 1 below). The exhibit shows the probability of success of each scenario given current asset levels, estimated rates of return based on varying portfolio allocations, and projected cost of living adjusted for inflation through the end of the plan.

EXIHIBIT 1

Developing a long-term strategy is crucial to ensure that a spouse receiving a lump sum distribution is making sound financial decision and doesn’t run out of money, due to lack of proper management and administration. These safeguards are especially important when spouses cannot work outside the home because they are raising minor children, ill, disabled, or already at retirement age.

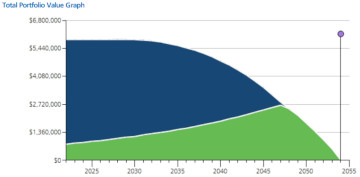

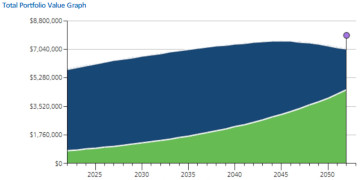

Exhibit 2 below compares the drawdown of a $5,000,000 settlement (shown in blue), with and without proper planning for the recipient spouse’s projected expenses. The blue represents all non-retirement assets including the proceeds from the sale of their home and the green represents retirement (tax-deferred) accounts. The illustration shows a complete depletion of assets before the end of the plan in the first scenario, compared to creating a plan that keeps up with the spouse’s goals in the second scenario after foresight, modeling, and planning.

EXIHIBIT 2

Graphical Illustration of Portfolio Drawdown – No Planning

Graphical Illustration of Portfolio Drawdown – With Planning

Nothing rewards me more as a planner than empowering someone to make decisions in line with successful outcomes. Planners also help capture and quantify people’s fears in worst-case scenarios, which ultimately helps them realize that things may not be as bad as they originally thought.

There is nothing we can do to change the past, but we can do a lot to educate and prepare people going through a divorce. Foresight provides them tremendous peace of mind. Time after time we see value in planning for the future and helping someone visualize what their life will look like after a divorce.